Bank stocks jump on RBI’s Rs 1.5L crore liquidity boost plan – The Times of India

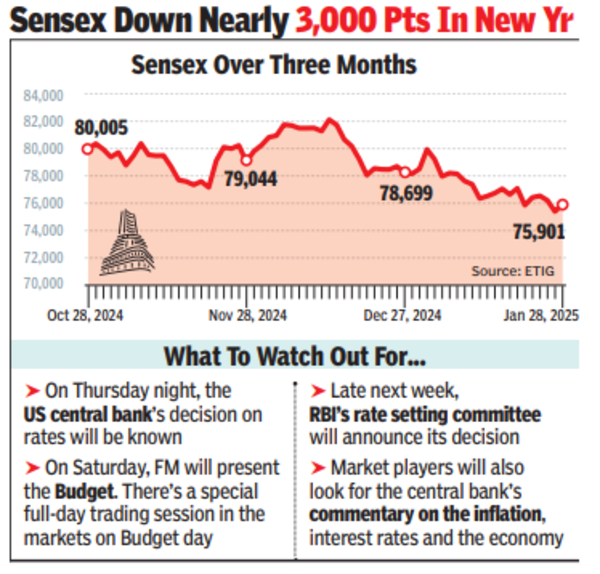

MUMBAI: The RBI’s Monday evening decision to infuse liquidity into the banking system led to a rally in banking stocks on Tuesday that, despite a late sell-off, mainly helped the sensex close 530 points (0.7%) higher at 75,901 points. At one point, the sensex was up nearly 1,200 points but the late sell-off, mostly by foreign funds, pulled the index down from its intra-day high.

On the NSE, the nifty too saw strong rally in early and mid sessions and a late sell-off, and eventually settled at 22,957 points, up 128 points (0.6%) on the day. HDFC Bank, ICICI Bank and Axis Bank added the most to the sensex’s rally on Tuesday. And BSE’s banking index, bankex, closed 1.5% up.

The feel-good effect of the RBI’s decisions on Dalal Street investors were strong enough to even discount the overnight sell-off in the US markets that was led mainly by a host of tech stocks. After DeepSeek, a low-cost AI model by a Chinese start-up shook the tech world during the weekend, Nvidia, the leading AI-chip manufacturer, lost about $600 billion worth of market value in Monday’s session. On Tuesday, however, as the dust settled, the stock was up about 2% in early trades.

The Tuesday’s gains in the two leading indices in the domestic market came despite foreign funds remaining aggressive sellers with the net outflow at Rs 4,921 crore, BSE data showed. So far this month, foreign portfolio investors have net sold stocks worth about Rs 76,500 crore, data from NSDL and BSE showed.

Despite a reversal in the two leading indices, the selloff in the midcap and the smallcap spaces continued. BSE’s midcap index closed 0.6% lower while the smallcap index closed 1.8% down. As a result, BSE’s market capitalisation was down by about Rs 70,000 crore to Rs 409 lakh crore.

According to Vinod Nair, Head of Research, Geojit Financial Services, on Monday, large-cap stocks outperformed, as their valuations have now reached fair levels and are further supported by expectations that the market correction is nearing its bottom. “In contrast, mid- and small-cap stocks continued to decline, as they remain overvalued. However, volatility is expected to remain elevated in the near-term in anticipation of the upcoming Union Budget, the (US) FOMC meeting, and the (derivatives) expiry.”

On Thursday night, the US central bank’s decision on rates will be known while on Saturday, FM will present the Budget. There’s a special full-day trading session in the markets on Budget day.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?