Dalal Street eyes on trade war even as FPI selloff pressure eases – The Times of India

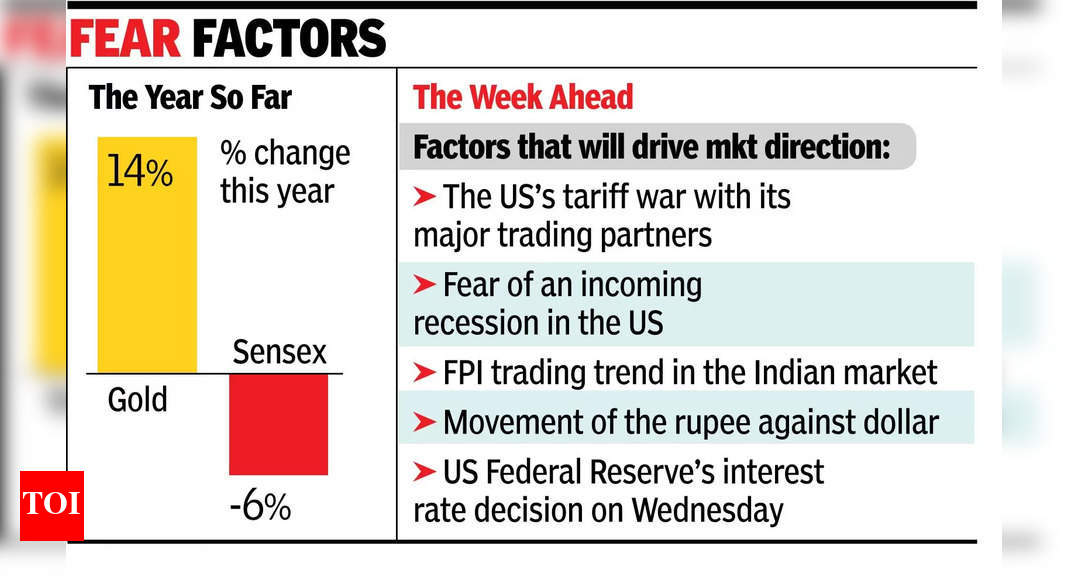

Mumbai: A host of global and domestic factors are expected to weigh on investors’ sentiment when Dalal Street opens for trading on Monday. The escalating global tariff war between the US and its major trading partners that include Canada, Mexico, China and the EU, and the rising fears of a US recessions – a fallout of the trade war – would be high on investors’ minds, market experts said.

Foreign funds’ trading activities in India would also weigh on the market. So far in March, foreign portfolio investors (FPIs) have net sold stocks worth a little over Rs 30,000 crore, taking the 2025 figure to close to Rs 1.5 lakh crore. However, the intensity of FPI selling is slowing, market players said.

In addition, continuous selling of Indian stocks by foreign funds, the dollar-rupee exchange rate, geopolitical developments in West Asia and Russia-Ukraine, and technical factors would also combine to decide the market’s direction, they said. During the week, investors would keep a watch on a host of data releases including FOMC interest rate decision, weekly US jobless claims and India wholesale price inflation for Feb.

Outside of the stock market, trading would also resume in the commodities market after the Holi break where lots of people would keep a watch on the prices of gold and silver in the domestic market. On Friday, the price of the yellow metal in the international markets had crossed the psychologically important $3,000-per-ounce (Oz) mark, an all-time high level. Prices of silver are also on a boil and are currently near its five-month high level of close to $34.5/Oz mark.

On Thursday, the sensex closed the truncated trading week at 73,828 points while Nifty was at 22,397 points. Both the indices were down on the week. On Wall Street too, the Dow Jones index lost over 3% during the week to Friday. According to Vinod Nair of Geojit Financial Services, although the escalating global trade war has weighed heavily on market sentiments worldwide, domestic factors have provided some relief with the Indian economy showing resilience.

Domestic market’s momentum, however, would continue to be influenced by persistent uncertainties surrounding global trade and the fear of a US recession. “The moderation in valuations, along with supportive factors such as falling crude oil prices, an easing dollar index, and expectations of a rebound in domestic earnings in the coming quarters, may limit the volatility and is expected to contribute to a stability amid prevailing uncertainties,” Nair said.