Dramatic reversal! Foreign investors leaving Indian stock markets for China – but here’s why India is still an attractive bet – The Times of India

Indian stock market indices, Sensex and Nifty, have come down significantly from lifetime highs. Investors have lost several lakh crore in the market correction and foreign portfolio investors have been withdrawing money continuously for several months now.

Foreign portfolio investors have continued their exodus from Indian stock markets in early March as well with substantial selling in information technology and consumer goods sectors, reflecting worries about economic conditions in both the United States and India.

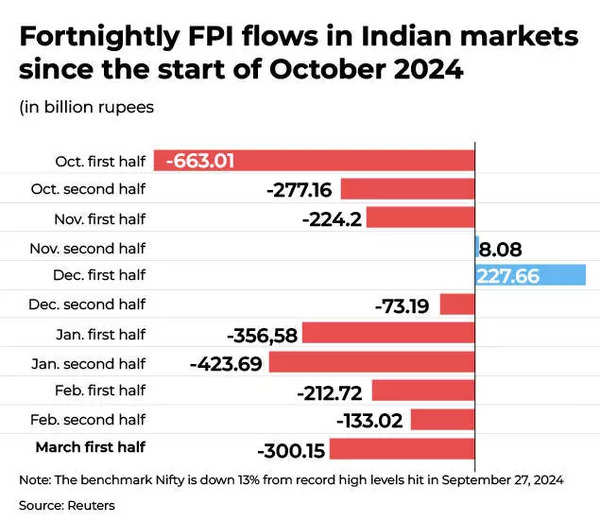

In the first half of March 2025, FPIs have net sold Indian stocks worth $3.5 billion. While the technology sector has seen net $803 million outflows, the consumer sector stocks have experienced $591 million offloading. Foreign investors have withdrawn approximately $29 billion from Indian equities since October, marking the largest outflow in any six-month period.

Fortnightly FPI flows

Where are foreign investors shifting their money to and why?

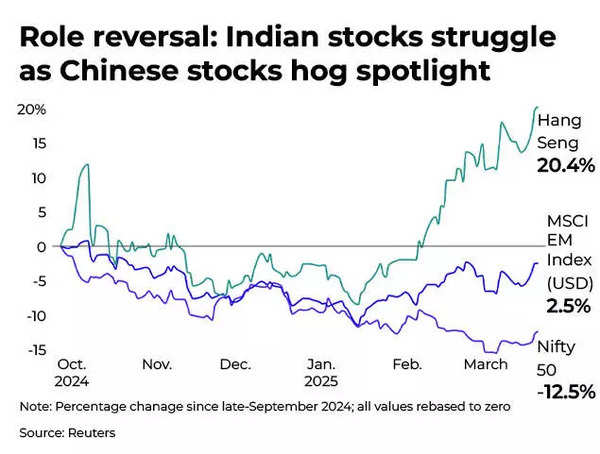

This money has moved towards China, where the Hang Seng Index in Hong Kong, has risen as much as 36% since late September. The inflows have come as a result of artificial intelligence investments centred around Chinese venture DeepSeek, says a Reuters report.

Foreign investors are shifting their investments to Chinese equities at an unprecedented rate from India – which is a big shift in investment patterns between these two major Asian economies over the past six months, the report says.

Role reversal: Indian stocks struggle as China stocks rise

- The Chinese stock market has emerged as an unexpected safe haven. This comes amidst the trade tensions due to US President

Donald Trump ’s tariff moves. The shift is primarily due to China’s relatively low valuations and anticipated economic uptick. China is focused on growth supporting policies and stimulus, which has attracted investors’ interest. - After a two-year period, China has surpassed India in terms of portfolio allocation at Britain’s Aubrey Capital Management. Rob Brewis, the portfolio manager, told Reuters, “Profits have been locked in from the last couple of years of strong performance by Indian stocks.Some of that has gone to China, some to Southeast Asia and elsewhere.”

Indian stocks have plunged drastically from their peaks seen in September due to CPI inflation worries and a high interest rate scenario. This has wiped out $1 trillion in market capitalisation from the Indian stock market. Investor sentiment has been negatively impacted by the slowdown in company profits and the sluggish economic growth rate, which is expected to be the lowest in four years during FY 2025.

Also Read | Trump tariffs impact: Is a US recession likely and does India need to worry about it?

Despite maintaining an overweight position on India, Morgan Stanley and Fidelity International have reduced their Indian holdings in recent months whilst increasing their Chinese investments.

But not all is as bleak as it looks. Market experts have expressed their confidence in the long-term prospects of the Indian economy and its markets.

Indian stock markets on path to recovery?

Though still well below their peaks, Indian equity benchmark indices BSE Sensex and Nifty50, have staged a smart comeback in the last five days. Equity investors’ wealth has surged by Rs 22.12 lakh crore during a five-day stock market rally, with the BSE Sensex surging over 4%. The total value of BSE-listed firms increased by Rs 22,12,191.12 crore, reaching Rs 4,13,30,624.05 crore over this period, according to PTI.

FIIs have shifted from their selling stance to become net buyers, influenced by accommodative signals from the US Federal Reserve indicating potential dual rate reductions this year. “This has reignited optimism in the domestic market,” Vinod Nair, Head of Research, Geojit Financial Services, said.

Siddhartha Khemka, Head – Research, Wealth Management at Motilal Oswal Financial Services points out that the Nifty has recovered 6.3% in the last three weeks indicating value buying at lower levels. “We expect this upward momentum to continue, on the back of the foreign institutional investors’ return to the Indian market amid attractive valuations and signs of economic recovery,” he said.

Also Read | Indian stocks look attractive! Sensex expected to recover lost ground against EM peers in 2025 – top 10 reasons

India vs China: Historical Returns & Future Prospects

Analysts point out that while the Chinese stock market has performed well in the recent period due to stimulus measures, Indian stock markets have in the last few years seen better returns.

Indian markets have beaten Chinese markets by 16.71% in the 5-year time frame and 8.07% in the 3-year time frame. “This highlights the strong performance of the Indian market, making it an attractive choice for long-term investing,” says Nabanita Dutta, Product Research, Anand Rathi Wealth Limited.

Another interesting fact is that Indian markets have shown consistency in performance with positive returns in the last six years. Whereas the Chinese stock market has been more volatile, recording negative returns in some years. “This suggests a higher risk associated with the Chinese market compared to the Indian market,” Nabanita Dutta of Anand Rathi Wealth tells TOI.

“FIIs have peaked their short positions in Feb 2025 at 85% short positions, and we are now witnessing signs of a reversal. Historically, whenever FIIs’ short positions have reached 85%, sentiment has shifted, indicating a potential trend change. Hence we can expect FIIs returning back to Indian markets in coming months,” she adds.

India stock market – Long-term story intact!

Many investors maintain their confidence in India’s potential. Amidst the ongoing global uncertainty, India will continue to be the world’s fastest growing major economy, IMF has predicted. The recent GDP growth of 6.2% in the third quarter and the RBI cutting repo rate in its February policy review signal that the worst of the slowdown is over for the Indian economy. Additionally, while global markets are jittery about the impact of US President Donald Trump’s reciprocal tariffs, experts have noted that India is relatively better insulated and less exposed.

“India has one of the best economic backdrops of the major markets, with plenty of economic drivers as well as stock market support,” Ryan Dimas, portfolio specialist for William Blair’s global equity strategies was quoted as saying by Reuters.

Morgan Stanley’s recent analysis in a report titled ‘India Equity Strategy and Economics’ confirms the country’s robust long-term outlook, with their sentiment indicator suggesting a compelling buying opportunity in Indian equities.

Also Read | Why Jim Walker, man who foresaw 2008 market crash, wants investors to ‘absolutely double down’ on Indian equities

“A likely positive shift in fundamentals is not in the price – we expect India to recover lost ground against its peer group through the rest of 2025,” says Ridham Desai, Equity Strategist at Morgan Stanley.

It maintains its Sensex target of 105,000 points for December 2025. Morgan Stanley notes India’s earnings growth trajectory is showing an upward trend, even with conservative consensus projections. They have identified India as ‘A stock pickers’ market’.

“The market has ignored the RBI’s policy pivot, and a strong budget from the government, among other positive developments since early February. India’s low beta characteristic make it an ideal market for the uncertain macro environment that equities are dealing with. Importantly, our sentiment indicator is in strong buy territory,” the report says.

According to Nabanita Dutta of Anand Rathi Wealth, India has strong GDP growth potential with estimated growth rate of 6.6% for FY25 which surpasses China’s 4.8% for CY24. “This positions India more favourably, highlighting its robust economic outlook. Market valuations appear reasonable with no major froth in Indian equity markets. We can expect Nifty 50 to deliver a CAGR of 11-13% over the medium term given the strong macroeconomic and earnings growth outlook,” she says.

Talking about the potential impact of reciprocal US tariffs under Trump’s administration, she says, “Today, the US imports 10.5% from China, while India represents only 2.5% of US trade. Since the U.S. imports nearly 15% of its goods from China, these tariffs will have a significant negative impact on China. This could create opportunities for India by potentially increasing its export numbers, as any tariffs imposed would likely be lower than those in China, giving India a competitive advantage.”

Also Read | Is a US recession coming? 7 charts that show the plight of the American economy